Table of Content

You cannot employ an untrained individual to work at your daycare and then pay for their training so that they fulfill the minimum educational standards. Tax season is a period of stress when you worry not only about filing taxes but about ways you could reduce the tax burden. Although no one wants to talk about it, there are several home daycare tax deductions that small businesses like daycare providers should be aware of. The maximum amount of qualified child and dependent care expenses that can be claimed on Form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying persons. You can use Form W-10, or any other source listed in its instructions to get the information from the care provider. You can't deduct the cost of your child's diapers on your federal income tax returns, which means you'll be paying taxes on the money you spent on diapers.

If you have a fixed site outside of your house where you offer daycare services, you are not eligible for this deduction. Tax class II takes into consideration an allowance for lone parents. Another requirement for classification according to tax class II is that the lone parent does not live in a cohabitation union or in a registered civil partnership. If you decide to rent your property in Germany you can take advantage of some attractive tax incentives. You can take advantage of these deductions via your annual income tax return.

How to Claim This Credit

The facility may have a commercial kitchen, playground equipment, swimming pools, and a large quantity of toys. The IRS provides helpful information about additional eligibility requirements that may apply to you. You are eligible for the refundable credit if you have your main home in one of the 50 States or the District of Columbia for more than half of 2021. Up to $8,000 for two or more qualifying people who need care – up from $2,100 before 2021.

If you decide to return to work, Kitas also bridge the gap until your child starts attending primary school at age 6. If you get audited and don't have receipts or additional proofs? Well, the Internal Revenue Service may disallow your deductions for the expenses. This often leads to gross income deductions from the IRS before calculating your tax bracket. No matter what you deduct, you must be able to substantiate or prove, that you are eligible for that deduction.

Refunds

You can easily do that by carefully keeping a completer record of all your business expenses. If you are overwhelmed with your business, you can reach out to a tax professional so that they can aid you in filing your taxes while you focus on the growth of your business. The first on our list of home daycare tax deductions are the costs of managing daycare workers. Workers' earnings, vacation pay, and insurance plans are all deductible employee expenses.

If your income is limited, you may be entitled to financial assistance. You can apply to the Jobcentre or Social Welfare Office responsible for you. Payable to your local tax office , this annual municipal tax is mandatory for all property owners in Germany.

Preschools in Germany (Kindergärten)

Driving done on behalf of your daycare qualifies as one of many deductions for home daycare business status.You can track your actual gas and oil costs or use the IRS standard mileage rate. This includes field trips and giving clients rides to or from their homes. You may also deduct mileage for trips made alone as long as the drive is necessary for the daycare's business operations, such as a trip to the bank, post office or grocery store. It is critical in this profession to be up to date with the current child care practices.

You have to enter both spouses’ gross salaries and tick the box, whether you have children. Your registration office will automatically forward your data change to the financial authorities in Germany. After a wedding, theFinanzamtwill change both spouses’ tax class to tax class 4 by default, regardless of whether one spouse is not earning any income or significantly less than the other. You have to change your tax class in Germany when your family circumstances change fundamentally.

If you are responsible for providing meals or snacks to your attendees, you can deduct the cost of these as you would other daycare supplies. The IRS recognizes that childcare centers and daycares come in all shapes and sizes. It provides some guidance to help you determine how to structure your childcare business and when certain regulations tend to apply. Let’s take a look at how the IRS defines different types of daycares and ten potential deductions you might take advantage of the next time around and run the best daycare service possible. Many of these organizations offer both in-person and virtual support.

While childminders and nannies in Germany are not required to be qualified early years educators, they do have to be registered with the local Youth Welfare Office . Costs vary, but on average a childminder will charge around 300 to 600 euros per month for a 20-hour week. Nurseries in Germany are run by a mixture of private, public and religious organisations. At Krippe, the emphasis is on socialisation, playing, singing and excursions, all under the supervision of early years educators. If you have owned your property for less than 10 years and choose to sell it, any financial gain made will be subject to capital gains tax of 25%.

The calculator also determines the employer’s contributions, which comprise pension insurance, unemployment insurance, health insurance and contributions for additional care provisions. All parents in Germany are entitled to a monthly child benefit to help make sure their children’s basic needs are covered. There are other allowances available for low-income parents to cover the cost of school trips and supplies. Before- and after-school care is a form of daycare for children aged 6 and above who are attending primary school. It is provided by the schools themselves, to help bridge the gap between school finishing and parents being able to collect their children after work. What your local Schulhort offers depends on the facilities available and local demand, and thus can vary hugely from region to region.

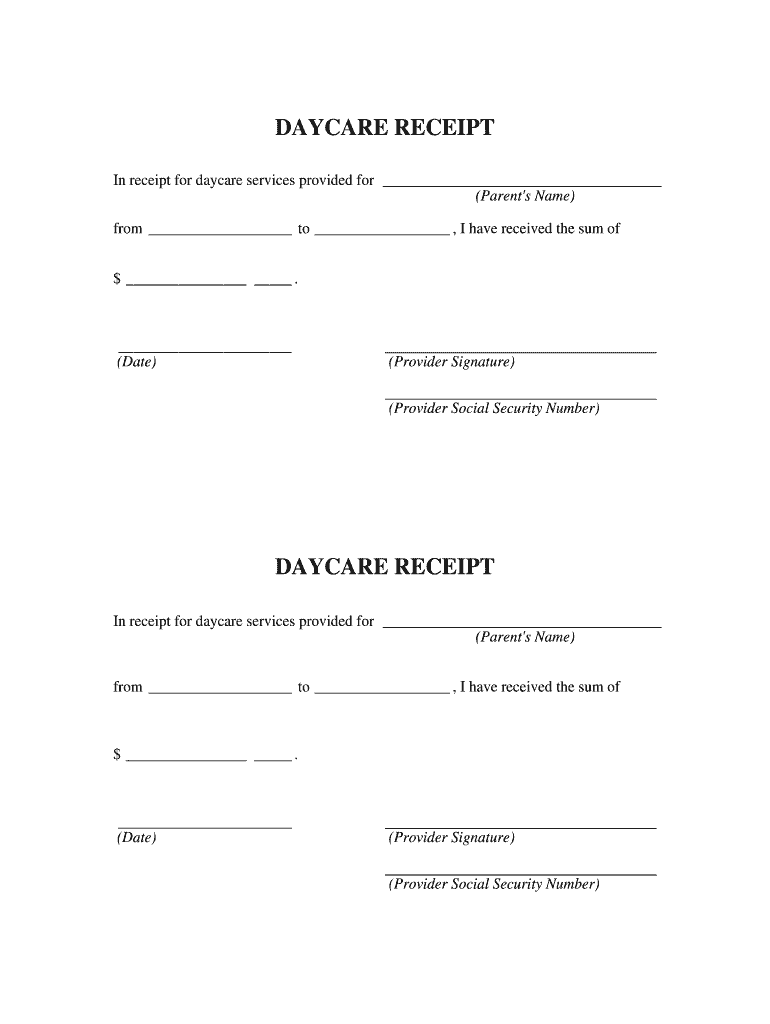

This includes items such as dish soap, laundry detergent, baby wipes and disinfectant, and consumables such as toilet paper, paper towels and garbage bags. You may also deduct food costs if you serve meals or snacks to children in your home. Use the time and space formula to split the expenses between the daycare and your personal consumption unless you keep separate inventories. You may deduct the full amount if you directly track the amount of each item you use for the daycare. When you file your tax return to claim the Child and Dependent Care Credit, you must identify all persons or organizations that provide care for your qualifying person. To identify the care provider, you must give the provider’s name, address, and taxpayer identification number.

No comments:

Post a Comment